Not just funding a partner in your journey

Seed investment

Growth & Beyond IPO

Growth financing

Having our investor support talent acquisition was a true advantage—reducing costs when resources mattered most, and connecting us with candidates we could genuinely trust. No HR firm could offer this level of alignment and reliability.

In the highly regulated and specialized healthcare industry, FuturePlay’s deep understanding of Huinno’s culture helped us find talents who truly fit — not only in skill, but in spirit. We look forward to continuing this strong partnership for Huinno’s sustainable growth.

Hiring great talent is never easy for a startup. From finding the right people and starting conversations, to convincing them and finally becoming one team — having FuturePlay as an investor walking with us through every step has been truly reassuring.

It may seem unusual for an investor to support hiring, but FuturePlay’s deep understanding of the startup ecosystem and its extensive network made the process more professional and systematic than any HR solution we’ve experienced. We believe this is a service every startup could truly benefit from.

FuturePlay creates investment and growth in a completely new way, together with founders

Behind every number, there was always a founder

액셀러레이터(AC) 겸 벤처캐피탈(VC) 퓨처플레이는 주요 정부 연구·개발(R&D) 지원 사업 전 트랙을 단계별로 연계·운영할 수 있는 체계를 구축했다고 5일 ...

이 기사는 2026년02월04일 18시08분에 마켓인 프리미엄 콘텐츠로 선공개 되었습니다. “성장하지 않는 회사는 답답하다. 퓨처플레이가 어떤 형태로든 우리가 정의한 방식의 성장을 계속 이뤄내는 회사가 됐으면 한다.”권오형 퓨처플레이 대표가 지난 1월 23일 서울 강남...

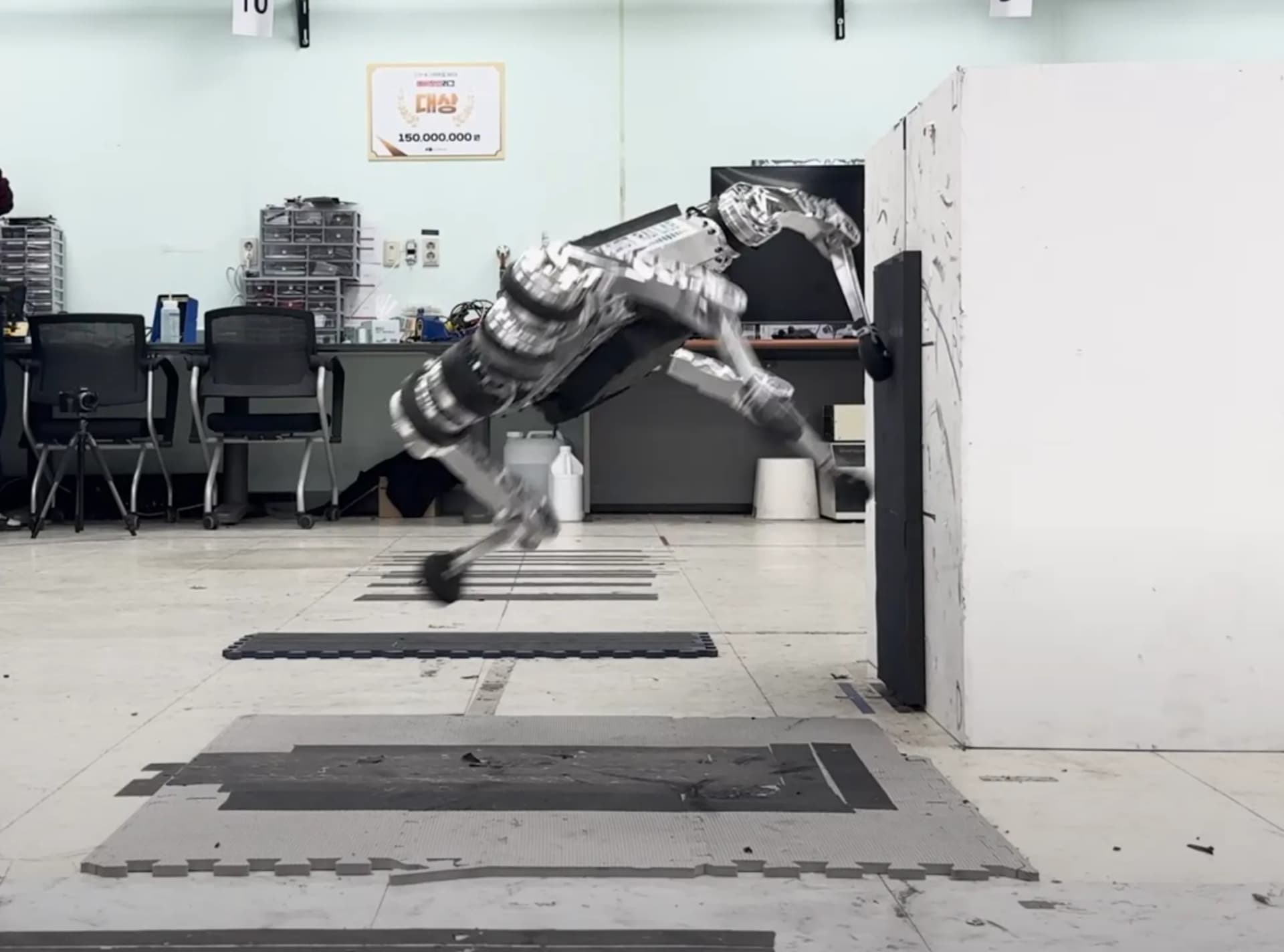

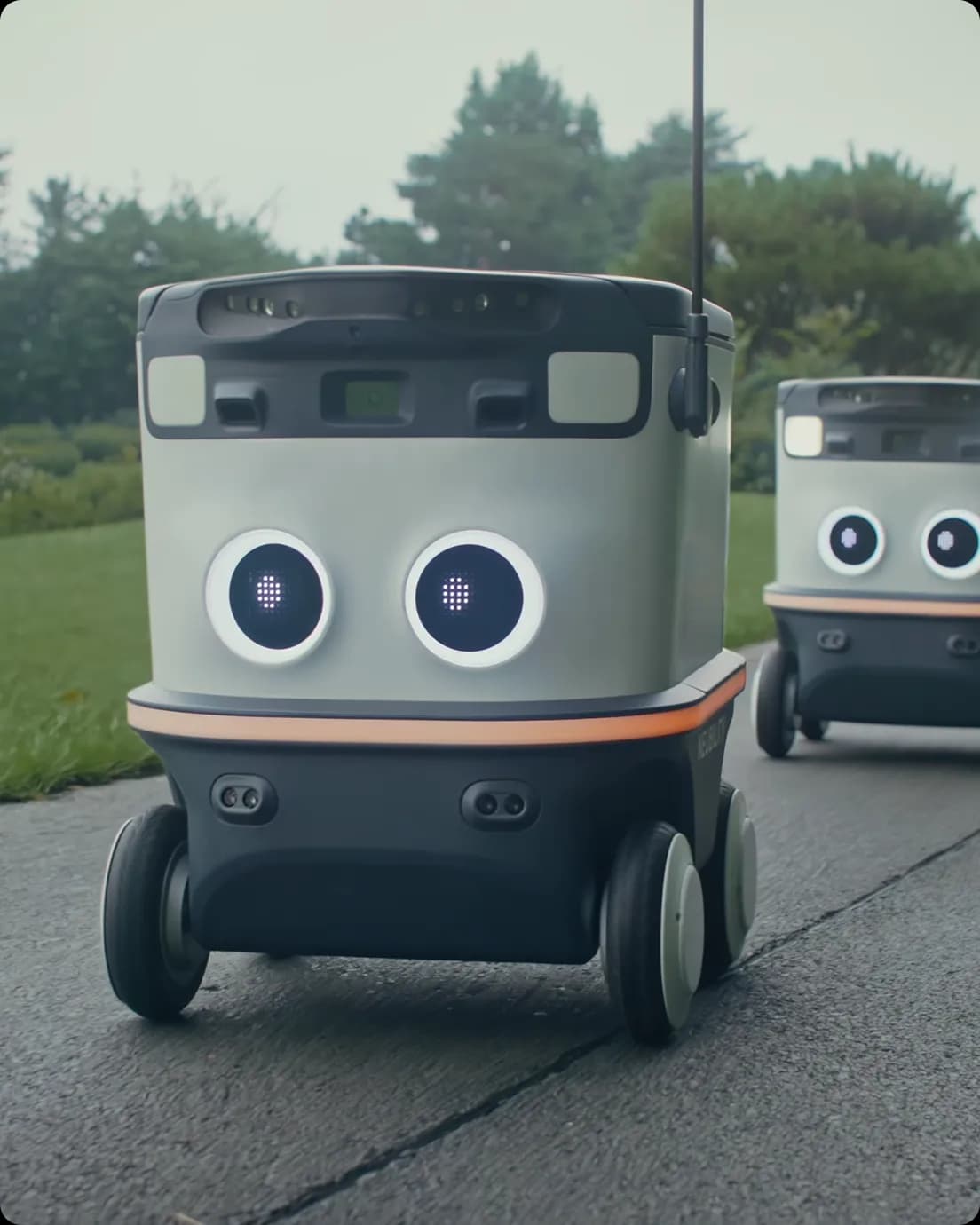

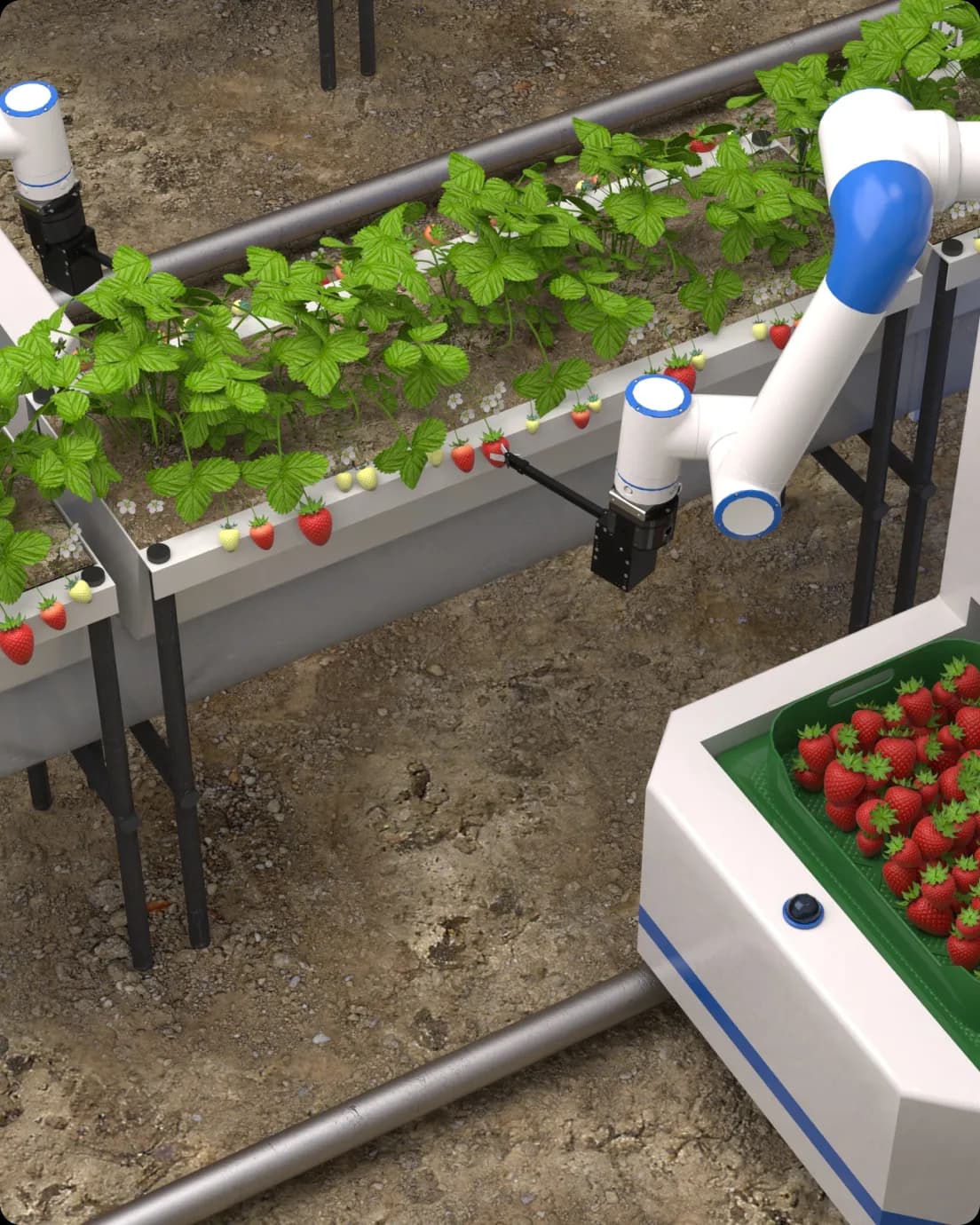

“인공지능(AI), 로봇 분야에서 삼성전자(005930)와 현대차 같은 기업이 될 옥석을 찾아내는 게 우리의 목표입니다.” 권오형(사진) 퓨처플레이 대표는 14일 서울시 강남구 사무실에서 서울경제신문과 만나 회사가

| 스마트에프엔 = 양대규 기자 | 컴투스 계열 투자사 크릿벤처스는 모듈형 로봇 자동화 플랫폼 개발 기업 위드포인츠에 15억원 규모의 프리 시리즈A 투자를 집행했

![[마켓인]퓨처플레이, 올해 43곳에 517억 투자…“스타트업 전주기 지원 강화”](https://image.edaily.co.kr/images/Photo/files/NP/S/2025/12/PS25122200367.800x.0.png)

국내 투자사 퓨처플레이가 올해 스타트업 43곳에 총 517억원을 투자한 것으로 나타났다.퓨처플레이는 주요 성과를 집약한 연간 성과를 발표하며 “올해 △총 517억원 투자 △스케일업 단계 지원의 실질적 성과 △글로벌 파트너십 성과 등 투자사로서 역량을 전방위로 확장한 ...

![[리얼퓨처] 10조 AI 가능? 경계가 무너진 2025, 성장 전략을 리셋하라 : ep 15-1](https://i.ytimg.com/vi/jly3Yq5mCH8/maxresdefault.jpg)

채널: FuturePlay 퓨처플레이

퓨처플레이가 2025년 팁스(TIPS) 프로그램 우수 운영사로 선정되고, 동시에 중소벤처기업부 장관 표창을 받았다고 19일 밝혔다. 퓨처플레이는 2014년 팁스 2기 운...

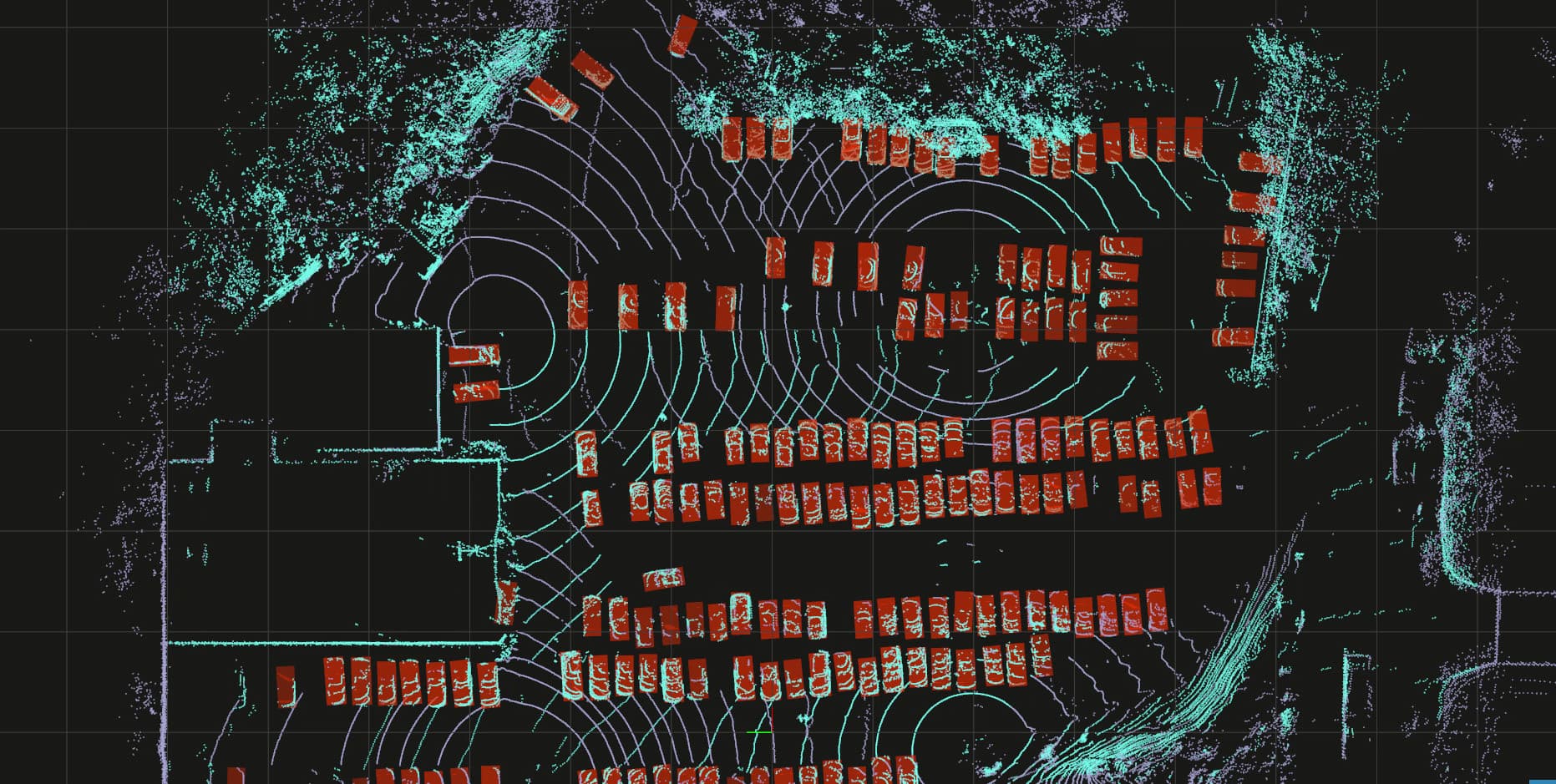

AI(인공지능) 기반 3D 머신비전 스타트업 클레로보틱스(옛 클레)가 일본 동경무역그룹의 핵심 계열사인 도쿄 보에키 테크노 시스템(TTS)과 일본 및 미국 시장에 대한 총판 계약을 체결했다고 16일 밝혔다.

캡스톤파트너스·미래과학기술지주 등 참여 기술창업 스케일업 성과 기여 공로

[프라임경제] 퓨처플레이(대표 권오형)가 2025년 민관협력 IP 전략지원사업(CIPO 프로그램)에서 '우수 운영사'로 선정됐다. 이로써 퓨처플레이는 한국발명진흥회장상을 수상해 기술 기반 IP 전략 역량을 공식적으로 인정받았다.4일 퓨처플레이에 따르면 회사는 올해 AI·반도체 전문트랙 운영사로 참여해 5개 스타트업의 CI..